As the 2026 tax season approaches, millions of Americans are preparing to file their federal returns with one key objective in mind: receiving their refund as quickly and smoothly as possible. For many households, a tax refund is not extra spending money. It supports essential expenses such as rent, insurance premiums, loan payments, tuition, healthcare, and emergency savings.

Understanding how the IRS refund schedule works in 2026 can help taxpayers set realistic expectations, avoid misinformation, and make smarter financial decisions early in the year.

When the IRS Will Begin Accepting 2025 Tax Returns

The 2026 filing season applies to income earned during the 2025 tax year. Based on historical patterns, the IRS is expected to begin accepting electronic returns in the final week of January 2026, with January 27 widely anticipated as the opening date.

Returns submitted before the official opening will be held and processed once the system goes live. Filing early still places your return near the front of the processing queue, but refunds cannot be issued before acceptance begins.

For taxpayers who prefer paper filing, mailing returns can begin earlier, though processing will not move forward until IRS intake officially starts.

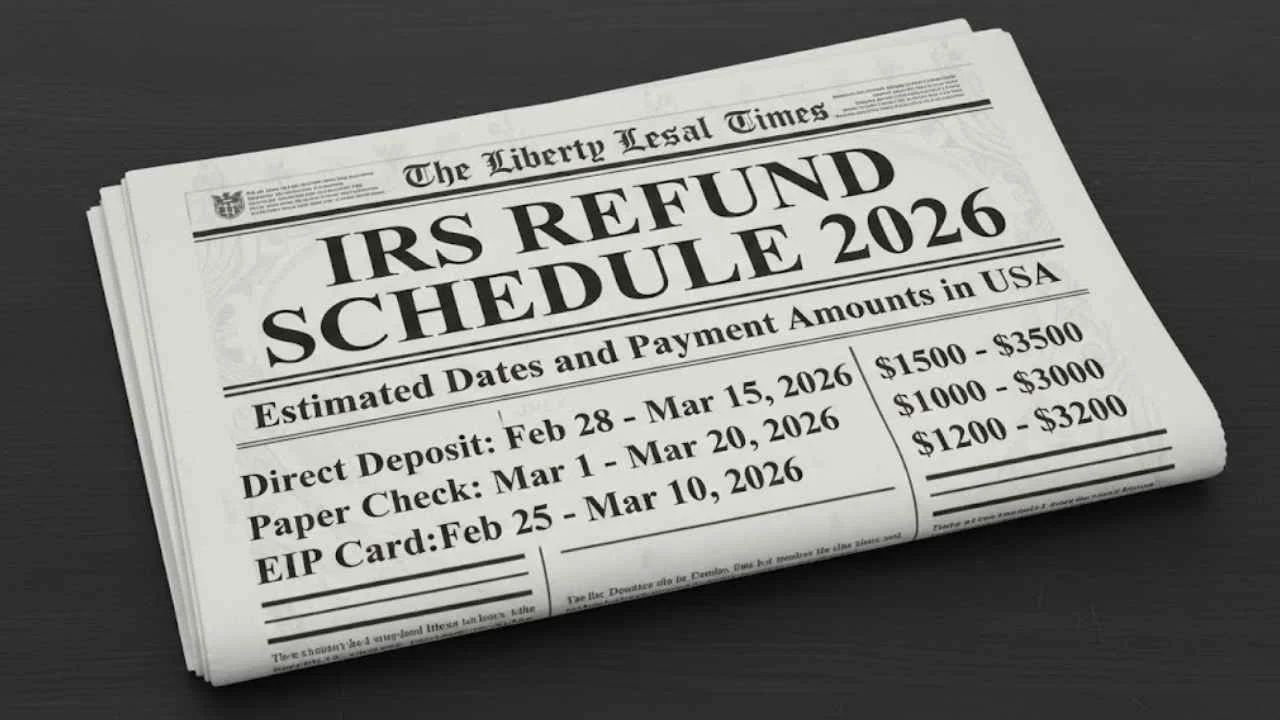

Estimated IRS Refund Timeline for 2026

Refund timing depends primarily on how you file and how you choose to receive your money.

Electronic Filing with Direct Deposit

This remains the fastest and most reliable method. Most taxpayers who file electronically and select direct deposit receive refunds within 10 to 21 days after the IRS accepts the return.

In many straightforward cases, deposits may arrive closer to the 10- to 14-day range. However, the IRS advises allowing up to three weeks for processing.

Electronic Filing with Paper Check

Choosing to receive a paper check instead of direct deposit typically adds additional mailing time. Even after the refund is approved, printing and postal delivery can extend the timeline by one to two weeks.

Paper Filing

Paper returns require manual handling and data entry, significantly increasing processing time. Refunds for paper filers often take six weeks or longer, particularly during peak filing season.

For those seeking faster refunds, electronic filing combined with direct deposit remains the most efficient strategy.

Refunds Subject to Mandatory Delays

Some refunds are delayed by law regardless of how early they are filed.

Returns claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) cannot be issued until mid-February. This policy is designed to reduce fraud and identity theft.

For 2026, refunds that include these credits are expected to begin arriving around February 18, assuming no additional issues are identified. Even if a return is accepted in late January, this delay still applies.

Taxpayers claiming these credits should plan accordingly and avoid depending on early February deposits.

What Influences Refund Amounts in 2026

Refund amounts vary significantly from one taxpayer to another. There is no fixed or standard refund.

Several factors influence the final amount:

- Total income earned in 2025

- Federal tax withholding from paychecks

- Filing status

- Number of dependents

- Eligibility for credits

- Retirement contributions or deductions

Some taxpayers may notice changes in refund size compared to prior years. Updated withholding tables, salary increases, additional income sources, or changes in tax law can all affect the final calculation.

It is important to understand that a refund simply represents the difference between taxes paid throughout the year and actual tax liability. A smaller refund does not necessarily mean higher taxes overall—it may reflect more accurate withholding during the year.

Common Reasons IRS Refunds Are Delayed

While most refunds are processed automatically, certain issues can slow down the timeline.

Errors such as incorrect Social Security numbers, mismatched income figures, or missing forms can trigger manual review. Inaccurate bank account or routing numbers may result in rejected deposits and require reissuance.

Identity verification requests can also pause processing. If the IRS requires additional documentation, responding promptly is essential to avoid extended delays.

Returns flagged for review due to suspected fraud or inconsistencies may take longer to resolve.

Careful review before submission remains one of the most effective ways to prevent refund delays.

How to Track Your IRS Refund in 2026

The IRS provides official tools to help taxpayers monitor refund status.

The “Where’s My Refund?” online tracker and the IRS2Go mobile app allow filers to check progress. Refund tracking typically updates once per day and displays three stages:

- Return received

- Refund approved

- Refund sent

For electronic filers, status updates usually appear within 24 hours of acceptance. Paper filers may need to wait several weeks before seeing updates.

Once the refund is marked as sent, direct deposits typically appear within a few business days, depending on bank processing times.

Filing Strategies to Receive Your Refund Faster

Taxpayers seeking efficient processing should focus on three core strategies:

- File electronically rather than by mail

- Choose direct deposit instead of a paper check

- Double-check all personal and banking information

Using reputable tax software or working with a qualified professional can also reduce errors, particularly for taxpayers with multiple income streams or complex deductions.

Ensuring all income forms, including W-2s and 1099s, are available before filing helps avoid amendments or corrections later.

Why Refund Timing Matters for Household Budgets

Tax refunds often serve as a financial reset at the beginning of the year. Many households use refunds to pay down high-interest credit cards, fund retirement accounts, cover property taxes, or build emergency savings.

Consumer spending typically rises between February and April as refunds are distributed. While refunds do not represent new income, their timing improves short-term cash flow for millions of families.

Planning around estimated refund windows rather than exact dates reduces financial stress and prevents reliance on costly refund advance products.

Final Perspective on the 2026 IRS Refund Schedule

The IRS refund schedule for 2026 follows a predictable framework, but individual timelines will vary based on filing method, accuracy, and credits claimed. Most electronic filers who choose direct deposit can reasonably expect refunds within three weeks of acceptance, while paper filers should anticipate longer waits.

Understanding the process, filing accurately, and managing expectations are the most effective ways to navigate tax season with confidence. With preparation and informed planning, taxpayers can approach the 2026 filing season strategically and minimize uncertainty.

Disclaimer: This article is for informational purposes only and does not constitute tax, financial, or legal advice. IRS policies, refund timelines, and tax laws may change. Refund amounts and processing times depend on individual circumstances. For personalized guidance, consult official IRS resources or a qualified tax professional.